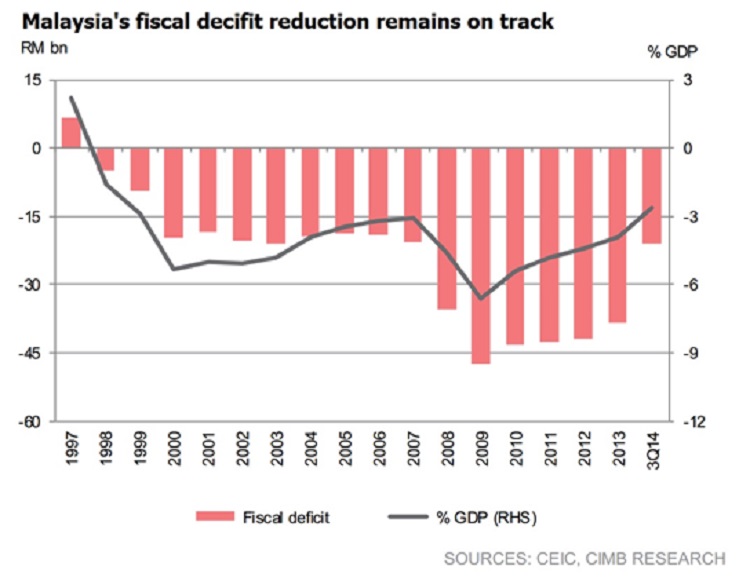

Malaysia is on track to achieve its 2014 federal budget deficit target of 3.5% of GDP, down from 3.9% last year. With the fuel subsidy removal locking in the impact of lower oil prices, the deficit could decline to below 3% next year, says International Monetary Fund (IMF).

In a statement following its visit to Kuala Lumpur and Putrajaya over 13-24 November, IMF commends the authorities for taking significant steps to strengthen the resilience of the Malaysian economy, while maintaining macroeconomic stability.

“The removal of fuel subsidies, the introduction of a goods and services tax (GST) and the strengthening of social safety nets are decisive moves that should help ensure the sustainability of government finances and allow more spending aimed at promoting sustainable and equitable medium-term growth,” it says.

Analysts and economists concur.

“We agree with the IMF that the moves to implement GST and subsidy reform will help Malaysia achieve its target of 3% budget deficit in 2015. The recent step in putting RON95 petrol and diesel on a managed float basis will cushion any loss in petroleum-related revenue from the government. It is hoped that such a managed float system will remain in place even in the event that oil prices rise again within an acceptable range, say up to US$100 per barrel, before any new subsidy structures are considered,” says Chris Eng, head of research and head of products and alternative investments at Etiqa Insurance & Takaful’s investment management division.

“Continued subsidy reform, i.e. the implementation of the fuel cost pass-through mechanism for electricity tariffs, combined with greater fiscal prudence in operating expenditure, should help Malaysia along to potentially secure a sovereign rating upgrade,” he tells Business Circle.

CIMB Research in its economic update says the removal of subsidies for RON95 petrol and diesel, which is in line with the government’s subsidy rationalisation agenda, is a positive sign of fiscal reforms progressing in the right direction.

“We think this should help the government achieve its fiscal deficit target of 3.5% of GDP for this year as well as further reinforces next year’s target of 3%. The savings from the government’s subsidy bill will allow it to better dictate the direction of the fiscal deficit,” CIMB Research says.

CIMB Research shares IMF’s view that Malaysia’s overall fiscal strategy should bolster equality, with budgeted cash transfers tightly targeted to low-income groups.

It says that if government revenue streams from oil-related revenues, GST and income tax collections remain intact, the RM12 billion earmarked for fuel subsidies can re-channelled into more targeted assistance, such as through Bantuan Rakyat 1Malaysia (BR1M) cash handouts, or into other more productive uses.

“Otherwise, the savings can be used to offset any potential declines in revenue as a result of slower growth or lower oil prices in order to keep its deficit reduction on target,” it adds.

IMF expects Malaysia’s current account surplus to rise to about 5% of GDP in 2014 on the back of slower import growth and modest recovery in external demand. It believes the current account surplus will remain comfortable in 2015, albeit narrow somewhat due mainly to lower oil and gas prices.

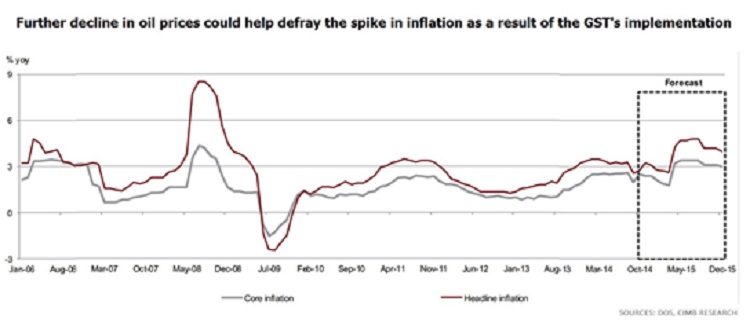

The fund notes Malaysia’s still-strong near-term growth prospects and projects real GDP growth of close to 6% in 2014. “While growth is expected to moderate to about 5.25% in 2015, private domestic demand is expected to remain robust. A moderate increase in inflation is expected in 2015 following the GST implementation but subdued underlying inflationary pressures will mitigate its impact.”

CIMB Research projects GDP growth of 6.0% for 2014 and 5.0% for 2015

IMF further notes that “Malaysia’s recent strong growth, high investment and improvements in business environment scorecards are impressive”.

“Achieving high-income status by 2020 will require steadfast implementation of a range of structural reforms, as identified by the authorities’ multi-year transformation programmes and the upcoming 11th Malaysia Plan. Continued infrastructure investment, supported by enhanced public finance management, can ease bottlenecks and support sustainable growth. These reforms, reinforced by continued financial sector development and greater financial inclusion, can accelerate productivity growth, encourage higher value-added activities, and help reduce income inequality,” it says.

“Malaysia should also benefit from its outward economic orientation and the strengthening of regional economic and financial integration underway, including the creation of the ASEAN Economic Community in 2015 and other regional trade initiatives,” it adds.