Spearheaded by managing director Dato’ Hussian Abdul Rahman, TFP Solutions Berhad is eyeing the ‘un-banked’ market comprising predominantly foreign workers, together with people living in rural areas throughout Malaysia.

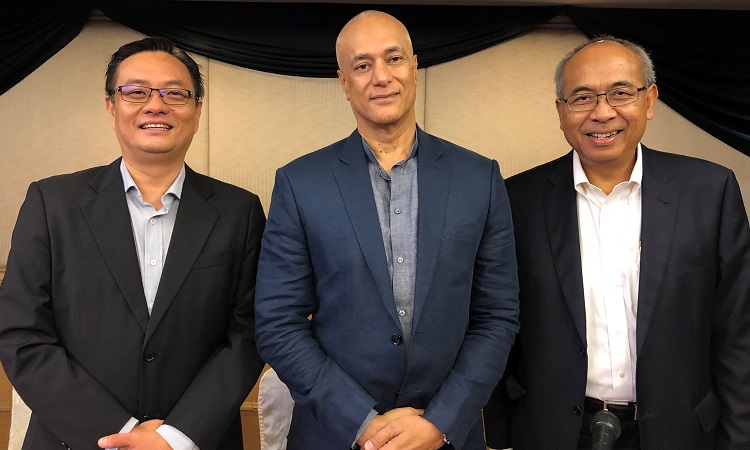

“Quite a number of foreign workers in our country do not have banking accounts,” said Dato’ Hussian (centre in main pic, with executive director cum CEO Abdul Latib Tokimin (right) and chief operating officer Simon Foong).

“Hence, challenges arise for both employees and employers when it comes to salary payment. I have personally witnessed how a renowned plantation company had to pay its workers collectively to the tune of RM1 million – and in cash – which presents risks for both sides.”

Dato’ Hussian believes that the solution would be for these foreign workers to have e-wallets.

“Our HRM (human resource management) solutions are already well known for various functions such as scheduling of workers schedule, online leave system, claims management and issuing payroll statements,” he said. “By integrating FinTech into our existing solutions, we aim to develop an e-wallet which will allow enterprises to directly deposit salaries to their employees’ e-wallets.”

The company is planning to launch its e-wallet service in the very near future, pending approval from Bank Negara Malaysia and the relevant authorities.

Besides its HCM solutions portfolio, TFP is also aiming to integrate FinTech into its existing campus management systems.

“Through the integration of Fintech into our campus management system, students will also be able to make use of campus e-wallet to perform cashless payment for any on-campus purchase,” said Dato’ Hussian.

“The digitisation of financial services is empowering customers to seek automated services online for greater convenience and more seamless experiences,” he added.

Dato’ Hussian was appointed to TFP’s board in early-2013, and re-designated as its managing director in mid-2018.

He is also the executive director and major shareholder of MobilityOne Limited which is listed on the Alternative Investment Market of the London Stock Exchange. The company is an e-commerce infrastructure payment solutions and platform provider that is known to work closely with most telecommunications companies and financial institutions throughout Malaysia.

MobilityOne was also accorded MSC status by Malaysia Digital Economy Corporation (MDEC) back in 2005.

Both TFP Solutions and MobilityOne continue to work closely with MDEC which had been chartered with “growing local tech champions”.

Dato’ Hussian was particularly full of praise for MDEC vice president (enterprise development) Gopi Ganesalingam (pic) whom he described as a “huge asset for Malaysia and who lives and breathes the MDEC mission of growing local tech champions”.

“Gopi is constantly encouraging and pushing us to do better for ourselves – and for the country,” said Dato’ Hussian.

“Gopi’s enterprise development team is similarly made up of experienced and passionate professionals who are committed toward the success of MDEC’s GAIN (Global Accelerator and Innovation Network) programme and for the benefit of local tech companies like ourselves to realise our fullest potential.”

MDEC’s GAIN programme is essentially about focusing on market access, visibility, raising capital and support for GAIN companies to emerge as industry leaders within their respective fields.