Barclays Research has been bullish about the Malaysian economy in the past 4-5 years and remains so despite plummeting oil prices, which has damped the nation’s growth outlook and drove the Ringgit to its lowest levels since the global financial crisis.

The Malaysian economy is resilient, stresses Barclays regional economist Rahul Bajoria.

“We still like the story here. We haven’t downgraded our 2015 GDP forecast for Malaysia yet. We still see 5.5% growth,” he tells Business Circle.

However, as Malaysia’s historical dependence on oil revenues has been so high – with oil-related industries accounting for a third of state revenue – the key risk, notes Rahul, is that fiscal deficit will come under pressure and that may spill into ratings pressure.

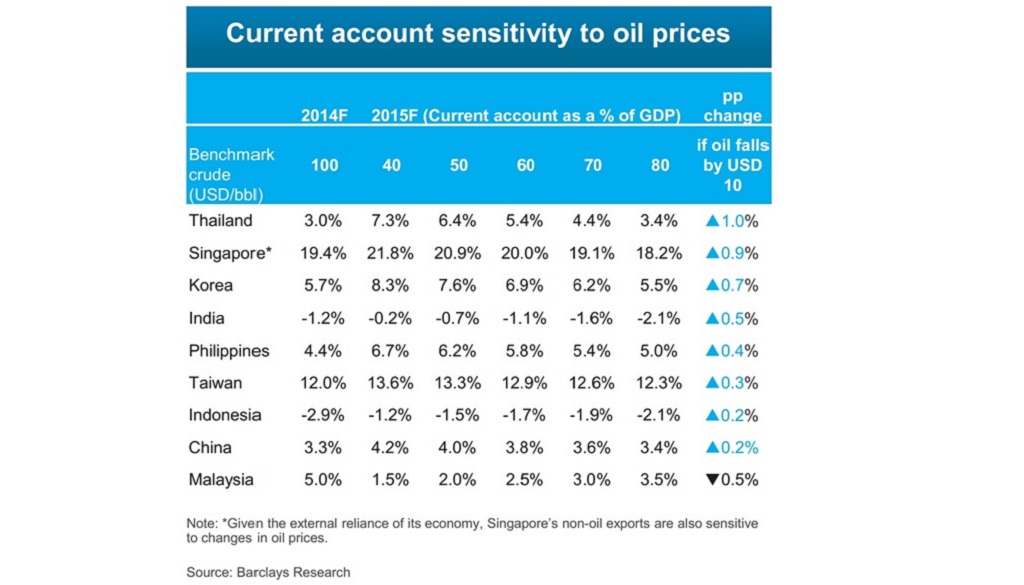

Meanwhile, the sliding Ringgit is not a major concern though it appears that way. The currencies of other energy exporting countries have similarly suffered; that’s the nature of a commodity currency. “It’s not extraordinary. It just looks so because Malaysia is the only energy exporter in the region.” Indeed, Malaysia is the only Asian country that is not benefiting from lower oil prices [see chart above].

Rahul (pic) believes the government’s target of reducing Malaysia’s fiscal deficit to 3% of GDP by next year is “doable” but might require some expenditure cuts. “Not a lot, about RM5-6 billion. With oil prices declining, these numbers change almost every week now. In our initial calculation about a month back when the deregulation was announced, we reckon that RM5-6 billion cut should do it,” he says.

Rahul (pic) believes the government’s target of reducing Malaysia’s fiscal deficit to 3% of GDP by next year is “doable” but might require some expenditure cuts. “Not a lot, about RM5-6 billion. With oil prices declining, these numbers change almost every week now. In our initial calculation about a month back when the deregulation was announced, we reckon that RM5-6 billion cut should do it,” he says.

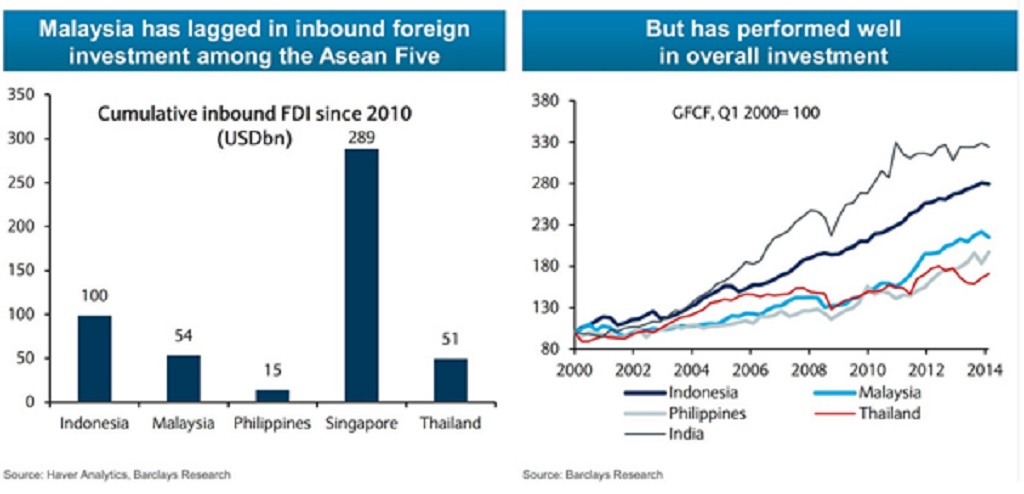

Barclays had generally been bullish about Malaysia in the past 4-5 years, says Rahul. “We have always believed that what has been done on a macro level is quite positive, as far as the ease of doing business and the improvements that have come through. Overall investment in the economy has been very encouraging, especially since the launch of the Economic Transformation Programme [ETP]. And these are being reflected in the stability of growth numbers as well.”

He notes, however, that the lack of growth on the export side has been a huge drag on the economy for the past five years, resulting in the contraction of the current account surplus from around 15% to around the 4-5% levels. “The export outlook is going to remain fairly benign and a big headwind for the country.”

“But what is happening on the public investment side is quite encouraging – you have the ability to spend. The problem in Asia is not that the government spends too much but that it is not able to spend enough,” he says, using Thailand and Indonesia as examples.

In addition, Malaysia has many investment projects running simultaneously; not everything is dependent on government revenue and spending.

“You have a pretty liquid financial markets and a fairly vibrant bond market, which helps in terms of funding some of these long-term projects,” he says.

Rahul highlights the fact that Malaysia has done relatively better than others in the region. “Apart from Singapore and Korea, to a certain extent, Malaysia’s financial market is actually quite liquid. That makes a pretty big difference. You don’t have any financing constraints as far as local borrowers are concerned,” he says.

In terms of attracting FDI, Rahul says Malaysia has had a mixed performance relative to its neighbours, particularly Singapore. While the overall investment in the economy has been very encouraging, especially since the launch of the ETP, the growth strategy has been largely focused inward and as such, Malaysia lags regional peers such as Indonesia in terms of capital creation.

“Indonesia just had an election, with a strong victory for Jokowi. If they make quick changes, it may have an impact on the relative outlook for FDI in neighbouring countries,” he says.

Meanwhile, India is building huge dedicated freight corridors (DFCs) for the manufacturing sector that are slated for commencement in five years. “Accordingly, you’ll see new factories, new industries coming up there. This could impact Malaysia’s relative attractiveness for FDI.”

While still bullish on Malaysia’s growth outlook, Rahul reckons that asset prices will remain somewhat under pressure, especially given the impact from low oil prices and a soft global outlook.

Rahul sees a need for some asset re-pricing. “We already see the housing sector slowing down and the Ringgit depreciating… There’ll be a bit of re-pricing of capital in the economy. Cost of capital needs to be considered.”

He notes that Bank Negara Malaysia (BNM) is generally quite prudent in its monetary policy and will be unlikely to lose sight of the need to adequately compensate savers to make sure people do not go into very risky assets.

“House prices are still going up and household debt in Malaysia is very high. You don’t want people to keep leveraging up to sustain their consumption levels. One way of preventing that is by adequately compensating the person depositing money – bank interest rates have to go up,” he says.

He believes BNM will raise its overnight policy rate (OPR) by Q4 next year. “The key question is whether they will raise it beyond 3.5%, the historical high. We’re already at 3.25%.”

As for the impact of the goods and services tax (GST) on inflation, Rahul says it will not be that significant as a lot of things are being kept out of the GST purview. “It’s only going to have an impact of 1.0-1.2 percentage points.”